Donor-Advised Funds: flexible, effective giving

Philanthropists are turning to Donor-Advised Funds as a convenient, swift and private way to give. They still benefit from the same tax reliefs as donations to other charitable structures, whilst also choosing the causes they support. Watch the video to learn more.What is a Donor-Advised Fund?

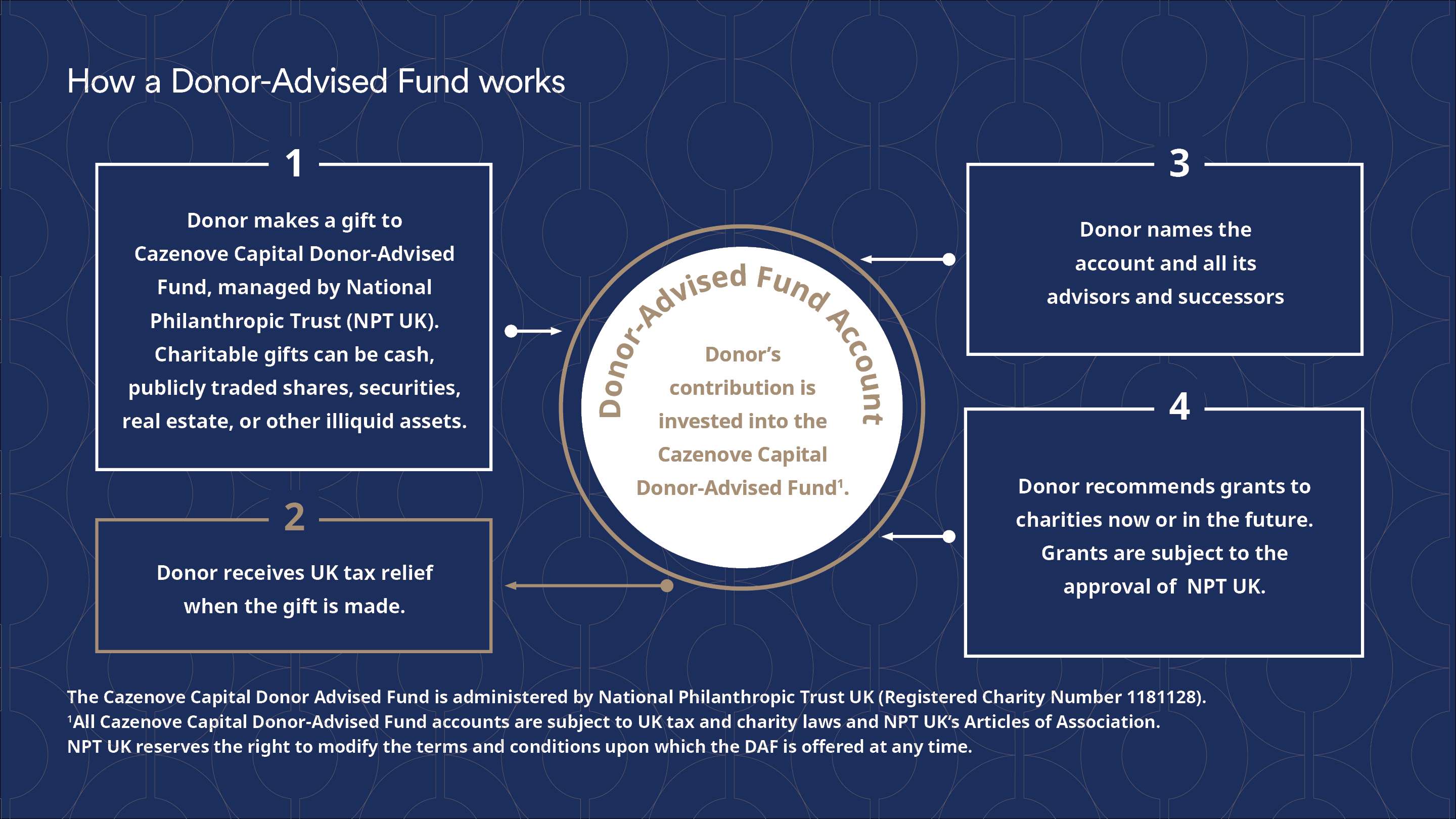

A Donor-Advised Fund (DAF) is a charitable giving vehicle that enables individuals to outsource the administration and operational complexity of running their own charity, allowing them to focus on strategic giving to specific charities over time. DAFs can facilitate timely giving, with the same tax benefits available as giving directly to charity’. They reduce the level of administration, and provide a higher degree of privacy, than setting up a charity. As a result, many more philanthropists have been turning to DAFs in recent years as the preferred vehicle for their strategic giving.

Cazenove Capital’s Donor-Advised Fund

Cazenove Capital, offers our own Donor-Advised Fund. Assets within the DAF are managed by Cazenove Capital and invested to provide the capital and income to fund your charitable giving, whether you are giving over decades, or spending down quickly. The assets can also be invested sustainably or to create a positive impact on people and the planet. Cazenove Capital‘s DAF is administered by National Philanthropic Trust (NPT UK), an independent UK charity. Together we deal with all administration of your DAF which allows you to focus on the causes you care about.